Your search returned 0 results. Try Again?

DEcember 17 2025

December Edition

Financial fraud is on the rise, affecting more individuals and businesses each year. As scammers grow more creative with their methods and tactics, it’s becoming increasingly important to stay informed. Knowing the warning signs and understanding how to protect yourself and your finances can help reduce the risk of falling victim to fraud.

On this episode of Making Sense of Money, we sat down with Brian Erickson, a detective from the Lewiston Police Department for the past 25 years. Over this time, he has worked as a school resource officer and a major crimes detective. Now he focuses on complex fraud investigations. With his experience, it has given him a clear view of how scammers operate and how these crimes have an impact on people in the community.

key terms: fraud, cryptocurrency

November 15 2025

November Edition

Season of Giving is a very special time of year at P1FCU. This is a time when we can spread joy throughout our communities and partner with community members in giving back to others.

On this week’s episode of Making Sense of Money, we had the opportunity to sit down with Carlo, the owner of Lewiston Grocery Outlet, and Jason, our Community Development Specialist, to discuss how community partnerships are helping to feed families this holiday season.

key terms: partnership, holidays

October 15 2025

October Edition

When we think about abuse, typically our minds jump to physical or mental abuse. But there is another form. One that is quieter, and often less visible, but can trap someone just as deeply: financial abuse.

In our 20th Episode of Making Sense of Money, we sat down with Shelly Meisner from the YWCA. Shelly is an advocate with over 20 years of experience supporting survivors of abuse. She shared her insights into how financial control operates in toxic relationships and what resources are available for those who find themselves trapped in such situations.

In our 20th Episode of Making Sense of Money, we sat down with Shelly Meisner from the YWCA. Shelly is an advocate with over 20 years of experience supporting survivors of abuse. She shared her insights into how financial control operates in toxic relationships and what resources are available for those who find themselves trapped in such situations.

key terms: financial abuse, relationships

September 18 2025

September Edition

Have you ever felt overwhelmed by the idea of building credit? Or maybe you wish that someone had taught you about it sooner. Either way, you're not alone. In the latest podcast episode of Making Sense of Money, Tanis sat down with Kylie, Consumer Lending Program Manager at P1FCU, to discuss a new product designed to help you take those next steps in your credit journey.

key terms: credit building, short-term loan

August 21 2025

August Edition

When it comes to meaningful partnerships, few stand out like the relationship between P1FCU and the University of Idaho. In the latest episode of the Making Sense of Money podcast, President Scott Green of the University of Idaho and Chris Loseth, President and CEO of P1FCU, reflect on how their shared values and deep roots in Idaho are creating something greater than just a sponsorship.

key terms: partnership, sponsorship

July 18 2025

July Edition

Real estate investing isn't just for Wall Street moguls; it's for anyone willing to start, learn, and grow. That was the message loud and clear in our latest Making Sense of Money podcast episode, featuring Jessica Bean, CEO of Unlock Real Estate.

Jessica's story began in interior design, but after a few career twists and an unexpected opportunity, she found herself diving headfirst into the world of real estate investing, and hasn't looked back since.

key terms: investing, real estate

June 18 2025

June Edition

So, you know you should be investing and saving for the future but don't know where to start? Well, we sat down with Brett, P1FCU's Financial Advisor, on the Making Sense of Money podcast to get some help on unpacking some of the most common investment questions. Hopefully, what you learn here can help your journey toward financial well-being feel a whole lot more manageable.

Whether you're just starting out or looking to optimize your retirement plan, here is a breakdown of what you need to know.

key terms: investing, savings accounts

May 15 2025

May Edition

We love celebrating local entrepreneurs who turn big dreams into reality, so on this week's episode of our Making Sense of Money podcast, we sat down with Brittin Fleshman, owner of B's Bakery in Lewiston, Idaho. From baking in an Easy-Bake Oven to selling out her storefront every Saturday, Brittin’s journey is a sweet reminder that with passion, persistence, and a little financial know-how, anything is possible.

key terms: small business, entrepreneurship

April 17 2025

April Edition

Planning for college can be very overwhelming, especially when it comes to financial aid. Navigating the journey of tuition, scholarships, and the dreaded FAFSA can be a challenge for students of all ages. That's why we sat down with Soo Lee Bruce-Smith, the Assistant Dean of Enrollment Services at LC State, on our Making Sense of Money podcast. She shared some myths and invaluable tips that can take the stress out of financial aid.

key terms: college, financial aid, fafsa

March 27 2025

Fraud Awareness Month - Special Edition

Fraud is on the rise, and scammers keep getting sneakier. In our latest episode of Making Sense of Money, we sat down with Detective Tyler Crane from the Lewiston Police Department to talk about the fraud they have seen, how to spot red flags, and why trusting your gut could save you thousands of dollars. With March being Fraud Awareness Month, there is no better time to sharpen your fraud-fighting knowledge and protect yourself from scams.

key terms: fraud, scam, red flags

March 13 2025

March Edition

Buying your first home is an exciting and scary milestone; sometimes, the journey can feel overwhelming. With so many steps and financial decisions to consider, getting lost in the process is easy. But don't worry! P1FCU's VP of Mortgage Lending, Wes Gossage, joined the Making Sense of Money Podcast to break down everything you need to know to make your first home purchase a success.

key terms: homebuying, mortgage, tips

February 13 2025

February Edition

A recent report reveals that a growing number of families in America are struggling to put food on the table for their families1. Saving money on groceries can feel challenging, especially with rising prices. We invited Kesha Barden, a Nutrition Education Specialist at The Idaho Foodbank, to join us on our Making Sense of Money podcast.

key terms: groceries, budgeting, shopping

January 21 2025

January Edition

The holidays are a season of joy and family, and let's be honest, spending too much money on stuff you swore you'd keep under budget. Things like that inflatable snowman you just had to have - we've all been there. Now that the lights are packed away and the credit card statements are rolling in, you might wonder, "Did I need expedited shipping on everything?"

key terms: debt, budgeting, credit cards

December 18 2024

December Edition

Giving back is not only important to your community, but also to your personal well being, but it shouldn't be motivated by peer pressure or shame. Identify what causes align with your beliefs and values and make donations that fit your budget.

key terms: nonprofit, giving back, volunteering

November 21 2024

November Edition

If you've never had a budget before, you're not alone. A 2019 survey from CFP Board showed that 2 in 5 consumers have never had a budget before.1 A lot of people think of budgeting very negatively, Winnie Sun, co-founder of Sun Group Wealth Partners, told CNBC, "It’s sort of like telling someone they need to diet and eat healthy."2

key terms: budgeting, finances, well-being

October 23 2024

October Edition

We know it's only October, and for many of us, the Holiday Season is the furthest thing from our minds. But when you look at the calendar, the holiday season is only a few paychecks away. Planning ahead will help you avoid overspending and the need to use your credit cards or Buy Now Pay Later services to pay for items you can't afford.

key terms: short term loans, buy now pay later, holiday budgeting

September 26 2024

September Edition

As credit card balances have reached record breaking highs over the last year, one goal many Americans have made has been to pay down their debt.1 Aside from freeing up room in your budget, paying off credit card debt has another added benefit: it will usually help you raise your credit score.

key terms: credit card debt, credit score, credit

August 23 2024

August Edition

Many parents hesitate to teach their kids about financial literacy because they feel their own lack of financial savvy makes them unqualified. However, we couldn't disagree more. Teaching your kids financial literacy can be a fantastic learning opportunity for you as well.

key terms: financial literacy, kids, money

July 23 2024

July Edition

Summer is prime time for buying a home, and with inventory up 15% compared to this time last year now is a great time to buy. A lot of buyers find themselves caught off guard with all the expenses associated with buying a home, this newsletter breaks down every expense.

key terms: down payments, closing costs, home purchases

June 18 2024

June Edition

June 30 is the FAFSA filing deadline, what do you know about the Federal Application for Student Aid? If you have a student going to college in the fall, or a rising senior, be sure to read up on these key student loan terms.

key terms: student loans, FAFSA, college, federal student loans

May 21 2024

May Edition

Debt can feel isolating and paying it off can feel daunting. In reality, a large portion of the American public deals with debt on a regular basis, but understanding the difference between debt that helps and debt that hurts is fundamental to shaping your approach to debt.

key terms: debt, high-interest, mortgages, mental health

April 18 2024

April Edition

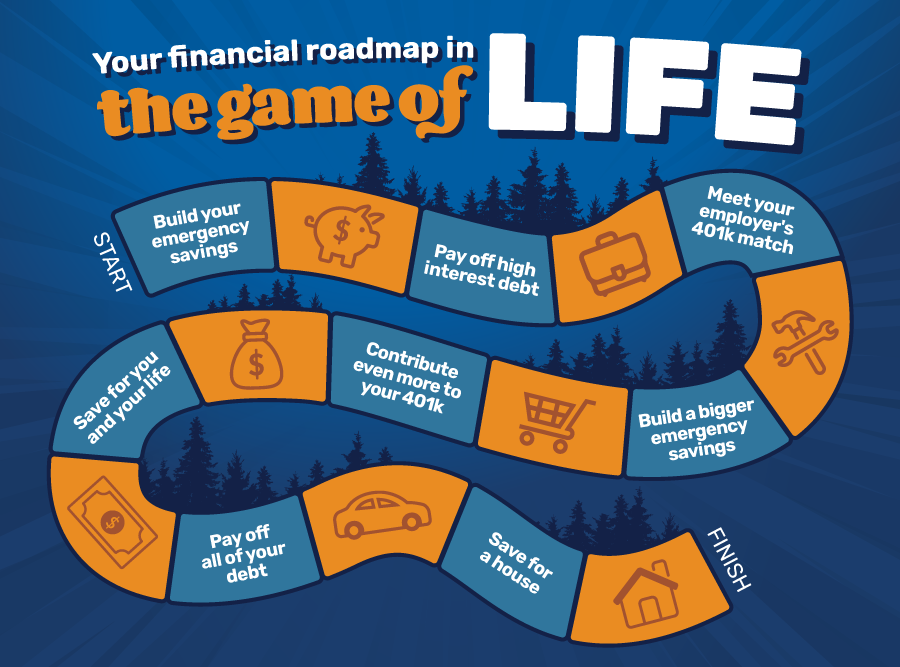

Sometimes, life can feel like it's passing us by so quickly that it's easy to get caught up in the present that we forget to plan for the future. A little bit of planning can go a long way.

key terms: saving goals, emergency savings, 401k, paying off debt

March 19 2024

March Edition

There are a lot of misconceptions about credit scores out there. This month we dive into some of the most common myths about credit scores, plus we share an exciting new tool for parents!

key terms: credit scores, greenlight, fraud prevention

February 15 2024

February Edition

Let's dive into the pros and cons of Buy Now, Pay Later Services. Are they right for you? Check out some of our recent community events and an information security tip.

key terms: short term loans, password security, online shopping