January's Basecamp Newsletter

The holidays are a season of joy and family, and let's be honest, spending too much money on stuff you swore you'd keep under budget. Things like that inflatable snowman you just had to have - we've all been there. Now that the lights are packed away and the credit card statements are rolling in, you might wonder, "Did I need expedited shipping on everything?"

You're not alone if your wallet feels light after the festivities. Andrea Woroch, a consumer and money-saving expert, said in a U.S. News article that "Millions of Americans are living paycheck to paycheck and just didn't have the extra money to pay for holiday purchases."1 The good news is that you can bounce back and start 2025 on the right financial foot with a few smart moves. Let's tackle the post-holiday debt blues together!

First - Assess the Damage

- Review your credit card and bank statements to calculate your total holiday spending.

- Break it down: What needs immediate attention, and what can be addressed over time?

- Figure out how much you owe on each account and the interest rate so you can prioritize what you pay off first.

Create a Post-Holiday Budget

All "new year, new you" cliches aside, January is the perfect time to reset your budget. It doesn't have to be overly complicated.

- Prioritize essentials like rent, utilities, and groceries.

- Set aside funds for debt repayment.

- Use the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings or debt.

- For more in-depth take on determining your budget, visit our blog Change the way you think about budgeting.

Tackle High-Interest Debt First

Since you have already determined your debt and interest rates on your accounts, you're ready to start paying off some of that Christmas cheer.

- There are two approaches to paying down your debt. The avalanche method involves paying off your high-interest debt first. This method is the best approach for saving the most money and paying debt off quickly.2

- Or maybe you just need some quick wins to keep you motivated. If so, the snowball method of starting with the smallest balances may be the best approach for you.

- Also, always make more than the minimum payments whenever possible.

Interested in a few more tricks?

Life Moves Fast, Go Digital

We all have busy schedules to start the year and sometimes it can be challenging to get to the branch. Did you know that you can do many things that members come to the branch for, in your Mobile or Online Banking, by using Video Banking or one of our ITMs? Learn more about our digital tools by clicking below.

Attend our Annual Business Meeting

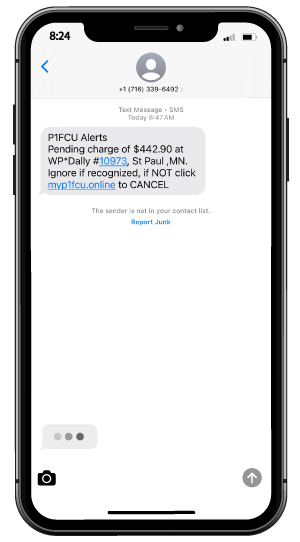

Have you been getting suspicious texts?

Subscribe to this Newsletter

References

1 U.S. News & World Report. (n.d.). Spent too much on the holidays? Here's how to manage a holiday debt hangover. Retrieved January 15, 2025, from https://money.usnews.com/money/personal-finance/spending/articles/spent-too-much-on-the-holidays-heres-how-to-manage-a-holiday-debt-hangover

2 Forbes Advisor. (n.d.). Debt snowball vs. debt avalanche: The best way to pay off credit card debt. Retrieved January 15, 2025, from https://www.forbes.com/advisor/credit-cards/debt-snowball-vs-debt-avalanche-the-best-way-to-pay-off-credit-card-debt/