Credit Score Workbook

What is a credit score?

A credit score is a number that represents your “creditworthiness.” This is what tells lenders how likely you are to pay them back.

Credit scores are important to your financial well-being. A high score makes you a stronger loan applicant. So, when you need to make a large purchase that you do not have cash for, like cars and houses, you'll be more likely to get a loan to pay for those items.

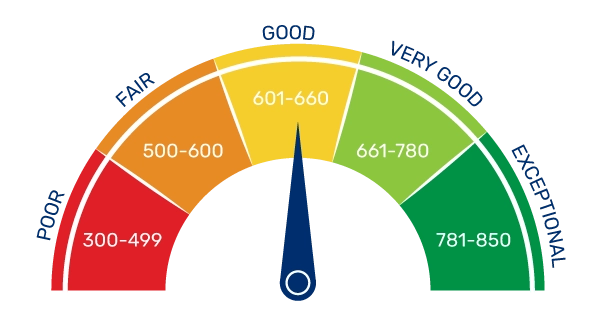

Credit scores range from 300 to 850. The lower your credit score is, the more difficult it is to secure credit. A high credit score makes it easier to secure credit and get a low rate on loans. It’s widely considered that you should aim for a credit score of 700 or greater. Typically, your banks, credit unions, and lenders report your credit information to one of, if not all, of the three credit bureaus: Experian, Equifax, and Transunion. From there, there are countless different credit agencies, two of the most popular being FICO and VantageScore.

Different credit bureaus tend to break your credit score into ranges from poor to excellent based on how low or high your score is. These breakouts vary between bureaus and institutions. Your VantageScore breaks out as follows:

How do I read my credit report?

You can get a free copy of your credit report from each of the three credit bureaus once per week by visiting annualcreditreport.com. You only get the report for free, not your score. If you want to see your score, you can expect to pay around $15.

Reading your credit report

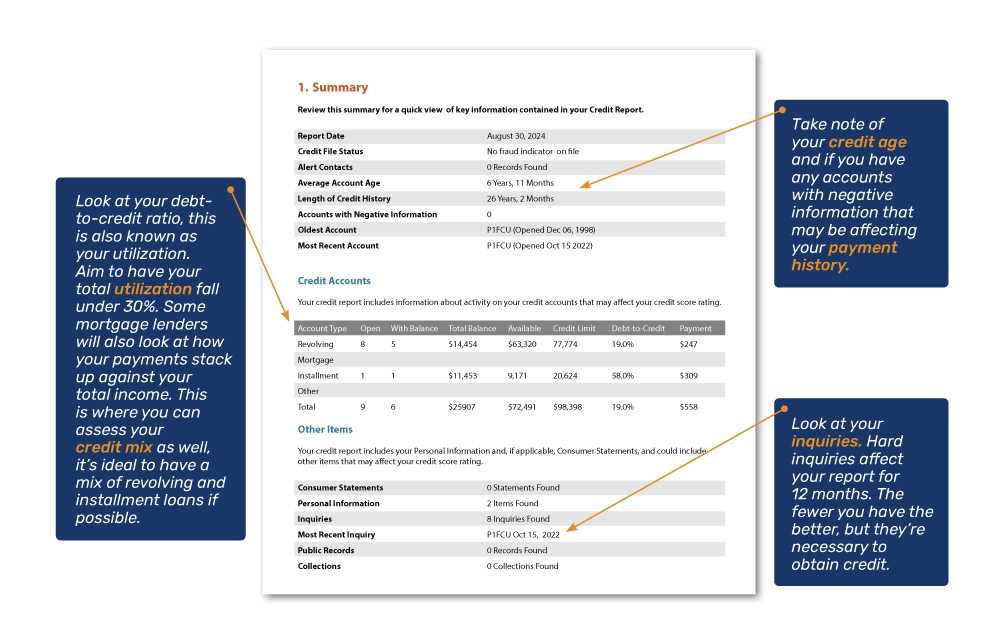

When you read your credit report, you’ll find your information at the top and then information about each of your accounts throughout. The report lists each of your accounts in detail, personal information, inquiries, public records, and collections.

For most consumers, the most important sections of the report will be the summary and three account sections: revolving, mortgages, and installment loans. The report will break down each account’s usage, payment history, and balance history. You’ll see if there are any reported late payments, high utilization, or other red flags. You’ll also want to check out your inquiries, and if you have any accounts in collections. You’ll want to verify that information is

factual as well.

Your credit report summary

You can also check your FICO score at myfico.com, where you can access your FICO 8 score for free. FICO has multiple different scoring models, but unless you need to do a deep dive into your score, it’s not likely you will need to pay to view your other scores from FICO. The score you see on myFICO may not be the same one a lender pulls due to the timing of the credit pull or the scoring model they use.

Credit Score

P1FCU members can check their credit scores for free using Credit Score in their Digital Banking. Credit Score provides access to your VantageScore, as well personalized analysis of your credit score and ways to improve it.

5 factors that affect your credit score

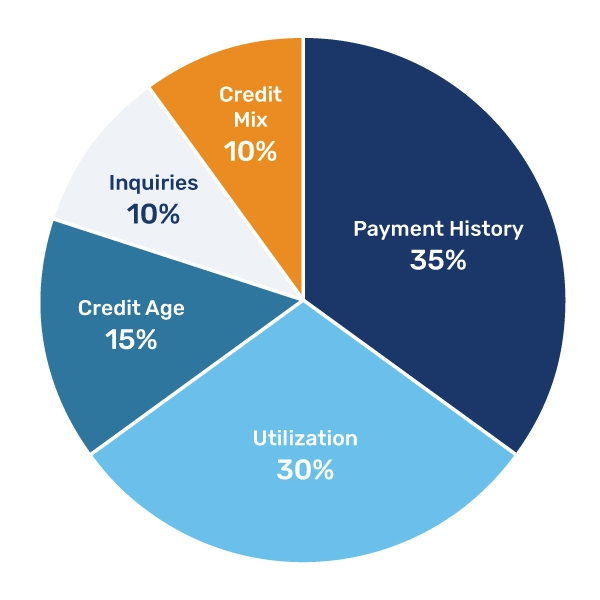

Your credit score is made up of five categories. These categories carry a different amount of weight in how much they affect your score. The categories are payment history, utilization, credit age, inquiries, and credit mix.

Payment History

Your payment history is, just as it sounds, your record of making payments toward your debts. There should be some clarification made about what debt repayments are included in your payment history.

On-time payments made toward loans and credit cards make positive contributions toward your payment history. Late payments are judged by frequency,

severity, amount owed, and recency of the event. Your payment history also includes public records like bankruptcy, foreclosures, judgments, liens, and

garnishment collections. Negative judgments will fall off your credit report within seven to ten years.

As you may have noticed, things like on time payments toward utility bills, medical bills, buy now pay later services, and so on, do not affect your credit. That said, if these bills are extremely overdue or go to collections, they will be reported to the credit bureaus.

Credit bureaus now allow you to pay to self report rent, utility, and other monthly payments. If you need to strengthen your credit, this is one option available to you.

Red flags to watch for:

Your payment history makes up 35% of your credit score. Late payments are very impactful on your credit score. This is a part of your score that can only be

improved as you move forward.

Red Flag: You have late payments.

Action item: Set up automatic payments for your loans and credit cards if you struggle with remembering when your payment is due.

- If your payment is due on a bad day of the month for you, ask your lender if you can change your payment’s due date.

- Tip: Once you’re caught up on your payments, a creative solution is to set aside part of your payment or the full amount gradually throughout the month, using the paycheck from which you’d like to make your payment.

Credit Utilization

Credit utilization, also called capacity, is how much of the credit that is available to you that you are using. Try to keep your credit utilization under 30%. When your credit utilization is this low, it will reflect positively on your credit report. For example, if you have a $10,000 line of credit, try to use $3,000 or less at a time. This low utilization shows lenders that if they extend credit to you, you won’t immediately max out your lines of credit.

Credit utilization primarily takes into consideration your revolving credit lines, like your lines of credit, credit cards, and home equity lines of credit. Installment loans, like auto, mortgage, and personal loans, do more to build your credit history, and if they're used to pay off your credit lines, can be quite impactful in lowering your utilization.

Red flags to watch for:

Your utilization makes up another 30% of your credit score. It’s recommended to keep your total utilization below 30%, but the lower your utilization, the better. Furthermore, if your overall utilization is low but one credit card has a high balance, that can hurt your score.

Red Flag: Your balance each month is higher than 30% utilization.

Action item: Pay your balance before your billing period ends.

Lowering your utilization can either be an easy fix, or it can take time to bring your utilization down if you have a lot of debt to pay off. A third option that we mention with caution is to request a higher credit limit on your cards. This would increase your total credit limit and lower your utilization, but be careful not to use more credit than you can manage.

Length of Credit History

Showing that you have a long history of managing your loan payments is also a good indicator to lenders that you can handle a new loan. This is why you should avoid closing out old credit card accounts when possible. If they’re not charging you an annual fee, keeping an old credit card account open is well worth it, even if you rarely use it.

As a note, if you’re keeping an old account open, be sure to use it occasionally to avoid it getting closed due to inactivity.

This is where it gets complicated with paid-off loans; when you pay off installment loans, it may briefly harm your credit score. This is because open and active accounts are scored more highly. They show you are actively making payments toward them.

That said, don’t let a brief hit to your credit score deter you from paying off your debt. Just keep in mind that you should have another type of open credit account on your report to show you are actively managing your credit, like a credit card.

This also goes to show, you should research your cards when you open them. Make sure they don’t have annual fees. If they do have annual fees, make sure they’re something you can commit to for the long term.

Red flags to watch for:

Your credit history, while important, only makes up 15% of your score, compared to the 30% and 35% that utilization and payment history make up. The reason for this is because your credit history is dependent on choices you may not have had control over, like whether your parents added you as an authorized user on their cards when you were a kid.

Red Flag: When you’re opening a new credit card, take into account whether the card charges an annual fee or not. You don’t want to get caught in a card that charges an annual fee that ultimately you want to close because of the annual fees.

Action item: Don’t close out cards you’ve had for a long time.

Reality: Paying off your installment loans does affect your credit score, but only for a brief amount of time.

Credit Inquiries

Inquiries tend to be less consequential for your credit, but they are important to keep in mind. Credit inquiries are when lenders check your credit report when you’re applying for a loan or a credit card. The reason why inquiries impact your credit score is because they reveal any borrowers who may be trying to take advantage of the system or applying for too much credit at once.

With inquiries, it is important to know the difference between a hard inquiry and a soft inquiry. A hard inquiry is when a lender checks your credit report because you’ve applied for a loan or credit card. A soft inquiry is when you check your own credit report or score using a tool like Credit Score. Inquiries have the shortest lasting impact on your credit score, falling off after two years.

Red flags to watch for:

Action item: Avoid another credit pull if possible for at least two years. If you are shopping for a vehicle or rate shopping, only make inquiries within a short time period.

Credit Mix

Lenders also need to see that you have a good mix of credit. If you only have credit cards or only have installment loans, this doesn’t always

show great management of these different account types.

That said, credit mix tends to have the smallest impact on your credit score. If you’re on your journey to being debt-free, don’t let the idea that

you won’t have a good enough mix of credit get in the way of paying off your debt. Your history of paying off your debt will outweigh your lack of

a mixture of accounts.

Your credit score is extremely important to your financial well-being. Understanding how it works and how your actions affect your credit score only further empowers you to make greater strides toward a stronger financial future.

Red flags to watch for:

Action item: If reasonable, apply for a loan that is different from what you currently have. If you only have installment loans, look into getting a credit card with no annual fee. If you only have credit cards, when you make your next large purchase, consider using an installment loan to pay for it.

Who calculates my credit score?

Lenders rely on credit agencies, who get their data from the three major credit bureaus: Experian, Equifax, and Transunion. There are countless credit agencies out there, but only three credit bureaus. All of these institutions calculate scores based on their own scoring models.

These different bureaus receive information about your credit history and compile your credit history. Your creditors may report to different bureaus. These credit bureaus take your credit report and calculate your credit score. While lenders report to these bureaus, you can also engage with them in a few ways. First, you can get your credit report and score from them. Next, you can actually freeze your credit with the credit bureaus.

Freezing your credit score is a fraud prevention method where the credit bureaus will not share your information with any other organizations. This makes it more difficult for scammers to access your credit report and apply for credit in your name if some of your personal information has been compromised. That said, if you are applying for credit, you will need to unfreeze your credit so that your lender can access your credit as well.

How to contact the credit bureaus if you find an error on your report:

Experian

888-397-3742

Equifax

888-378-4329

Transunion

800-916-8800

Why is there more than one credit bureau?

What is a FICO score?

Frequently, the terms FICO score and credit score are used interchangeably. Your FICO score is a score from a company that uses a proprietary scoring model that most lenders prefer. FICO aggregates information from the three credit bureaus, Experian, Equifax, and Transunion, and calculates your score based on that information.

FICO vs VantageScore

FICO and VantageScore are the two most popular scoring models. VantageScore looks at your credit account history, credit behavior and payment history. FICO delivers a snapshot of all available credit accounts, payment history, and historical data to determine your score.

How different actions affect your credit score

| Action | Points Lost | Comments |

|---|---|---|

| Inquiry | 5+ Points | Gain the 5+ points back 12 months after the date of inquiry |

| 30+ day late payment for any loan payment except a mortgage payment | 60+ points | Gain back approximately 40+ points when your payments are brought current. It takes up to 24 months to get the other 20+ points back. |

| Collection Items | 30 to 60+ points for every new collection item that is posted | Collection items get updated on your report as a new collection item every time it is sold to another collection agency |

Creating an action plan for your credit score

Setting S.M.A.R.T. goals

Specific: This section of your S.M.A.R.T. goal should include information like:

- Why are you setting this goal?

- What steps are you taking to reach the goal?

- Who will be involved? If this goal involves you, your spouse, or your kids, then include them when writing it.

Measurable: This section explains how you will measure completion of

your goal.

Achievable: This section should answer the following:

- Why are you confident you will reach your goal?

- What steps will you take to reach your goal?

- What skills do you have to reach your goal?

Relevant: This sections identifies that the goal is relevant to what you are trying to accomplish.

Time-Bound: Creating a deadline for your goal will keep you from pushing it off. Once you reach your deadline, you can evaluate the success of your goal.

Setting goals helps keep you motivated and disciplined as you achieve your goals. If you use the S.M.A.R.T. goal-setting strategy, you’ll be able to clearly see the path that will lead you to your goal.

example goal

Overall Goal: Lower Credit Utilization

Specific: I will lower my credit utilization by paying off my credit cards starting with the smallest balance first. If I receive any additional funds throughout the month, I will allocate them toward my credit card.

Measurable: My score should increase by at least 20 points.

Achievable: I will budget and use tools like Credit Score and the Money Manager in P1FCU’s Digital Banking to help me

Relevant: Paying off debt will help me lower my utilization and improve my credit score.

Time-Bound: 2 of 5 credit cards paid off by XX date. Remaining 3 cards paid off by XX date

Bucci, Steve. “How does payment history affect your credit score?” Edited by Dignelly Torres Vazquez. Reviewed by Cathleen McCarthy. Bankrate. www.bankrate.com/personal-finance/credit/payment-history-credit-score/. Accessed 6 September 2024

DeNicola, Louis. “What Is a Good Credit Score?” Experian www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-agood-credit-score/. Accessed 6 September 2024.

Denicola, Louis. “When Do Late Payments Get Reported?” Experian. 4 December 2019 https://www.experian.com/blogs/ask-experian/when-dolate-payments-get-reported/ Accessed 6 September 2024.

Denicola, Louis. “What Is a Credit Utilization Rate?” Experian. 5 November 2023 www.experian.com/blogs/ask-experian/credit-education/scorebasics/credit-utilization-rate/. Accessed 6 September 2024.

White, Jennifer. “How to Report Payment History to Credit Bureaus” Experian. 21 February 2021. www.experian.com/blogs/ask-experian/can-iadd-good-payment-history-credit-report/. Accessed 6 September 2024.

Disclaimer

While we hope you find this content useful, it is only intended to serve as a starting point. Your next step is to speak with a qualified, licensed professional who can provide advice tailored to your individual circumstances. Nothing in this workbook, nor in any associated resources, should be construed as financial or legal advice. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today.

P1FCU does not make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. P1FCU and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by using this workbook, you agree to release P1FCU from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.