First Time Home Buyer's Guide

How to buy a house 101

More Questions?

Deciding to Buy a Home

Signs You're Ready to Buy a Home

If you’ve been thinking about buying a home but you’re not sure you’re ready, here are some signs that homeownership is the right next step for you.

Buying vs. Renting

In some ways, making a mortgage payment may seem similar to paying your rent every month, but aside from the fact that both a rental and your home give you a place to live, that's where their similarities end. There is definitely a time and a place for both renting and buying.

Renting is great for shorter-term housing solutions. When you're renting, it's the landlord's responsibility to see to proper upkeep of the property and ensure that anything is broken gets fixed.

When you own your home, you get the perk of getting to customize your home and making modifications to your heart's content. That being said, when something breaks, leaks, or needs replaced, you need to make sure it gets fixed. For some people, this may be a relief. For others, it may seem overwhelming. At the end of the day, this is something all homeowners deal with.

All that said, the best part about homeownership is that you're continually building equity in your home. Your equity can help pay you back in the future if you need to borrow against it. In addition, any home improvements you make can help build even greater equity in your home. This all adds to the value of your home, adding a greater return on your investment when you eventually sell.

Prequalification

Once you decide you're ready to own a home, prequalification is the next step in your home search. While prequalification is not required, we cannot recommend them enough. Prequalification will help you during your home search in a few ways.

What is prequalification?

Prequalification is an easy process that won't take you too long. When you apply for prequalification, you'll be asked for information about the type of property you might want to buy. You'll need to provide the location of your potential home, estimated property taxes and insurance, and what you think the purchase price will be. These are answers that can be changed later on in the application. For the most part, the loan officer processing your application just needs a starting point to give you numbers.

When you apply for prequalification, there is also an inquiry on your credit. While these inquiries can damage your credit, the information gained from a prequalification is more valuable than the ding to your credit score. Even if you forgo prequalification, there will be an inquiry on your credit score later on in the mortgage process. The choice is whether you have it sooner or later.

Once you've submitted your application, you should hear back from your loan officer in less than a day. You'll be asked to send in your pay stubs, W2s, and other documents verifying your employment. You should usually have a good idea of how much you are prequalified for in less than a week.

How much can you afford?

Whether budgeting is a new practice for you or you’ve been sticking to one for a while, looking to buy a home is a great time to reevaluate your finances and assess what you can afford. Even if you’re prequalified for a certain amount, that doesn’t mean you can afford a loan of that amount.

Take a look at your budget. How does your savings stack up to your discretionary purchases and fixed expenses? Is your budget in a place where you can take on additional expenses, or would your mortgage payment need to be about the same as what you're currently paying for rent?

You can calculate how much of a loan you can realistically afford based on current interest rates by using affordability calculators online. That being said, try not to get paralysis by analysis. Everyone's situation is different, from their credit score, debt to income, and financial situation. These calculators can be helpful but don't dwell on them too long before contacting our mortgage team. They'll be able to provide you with clearer answers than a calculator can.

Finding a Home

Do I need a real estate agent?

While we by no means require that you work with a real estate agent in order to finance your mortgage, we do think it’s a good idea. Here are a few reasons why we think it’s helpful to work with a real estate agent when looking for a home.

First, agents will work with you to find the right home for you. While you have a good idea of what you want, they spend every day helping their clients find the right home. Real estate agents will help you find homes that fit your needs, from your budget to size, neighborhood, and amenities. Agents also usually know about homes that will go on the market before they're listed.

Once you find the right home, real estate agents will also help you make an offer on the home to help you get the best deal. Agents know about different negotiation options that might be available to you. Plus, if you're in a competitive housing market, Agents will help you provide the most attractive offer to the seller with the assets you have available.

Furthermore, real estate agents are licensed and capable of drawing up the necessary contracts to help you create a purchase agreement once an offer has been agreed upon. Agents are also familiar with the intricacies of the home-buying process, something that most people go through only a few times in their life. While we are happy to walk you through the lending side of buying a home, real estate agents will help you with other coordination between title companies, the seller, and the seller's Agent.

While real estate agents charge a fee for their services, we find the service they offer invaluable during the home purchase process.

Making an Offer on a House

Once you've found the right home, your real estate agent will help you make an offer on the home you want to buy. The type of offer you send the sellers depends on your local housing market. If you're in a seller's market, odds are you'll need to provide something over the asking price. You may have more room to negotiate in a buyer's market.

If you're buying in a more competitive market, you'll want to ensure your offer is as attractive to sellers as possible. Your offer includes more than just the amount you're offering for the seller's home. When you're prequalified, you will have a letter you can present with your offer. Your prequalification will assure sellers that you're committed to a home purchase and have done your due diligence to ensure that you can actually secure the funds needed to purchase their home. Along with your prequalification, you can also include a personal letter to the sellers about why you'd like to purchase their home. While this personal touch may not work for every seller, it has worked for some. To some sellers, taking the time to share your motivations and hopes for their home can give you a leg up when your offer may not be as financially competitive as others.

When it comes to negotiations, our number one tip is to ask for an inspection. If an inspection uncovers any major issues with the home, you can negotiate with the sellers to have them pay for necessary repairs. Your negotiations can also include having the sellers pay closing costs or other closing stipulations. What you can successfully negotiate depends on the seller, but your real estate agent can help you understand what tolerance for negotiations your seller has. While negotiating, we cannot stress the importance of communicating through your real estate agent enough. This prevents confusion, miscommunications, and any potential legal issues.

Looking for homes can be an emotional process. You want to love the place you're going to live! That said, if the negotiations aren't going your way and pushing you too far outside your budget, don't be afraid to walk away. We can assure you there will always be more homes on the market. Negotiating a deal that fits your financial condition is equally important as finding a home that suits your needs. The home search requires resilience and determination, but it's one that is well worth the effort in the end.

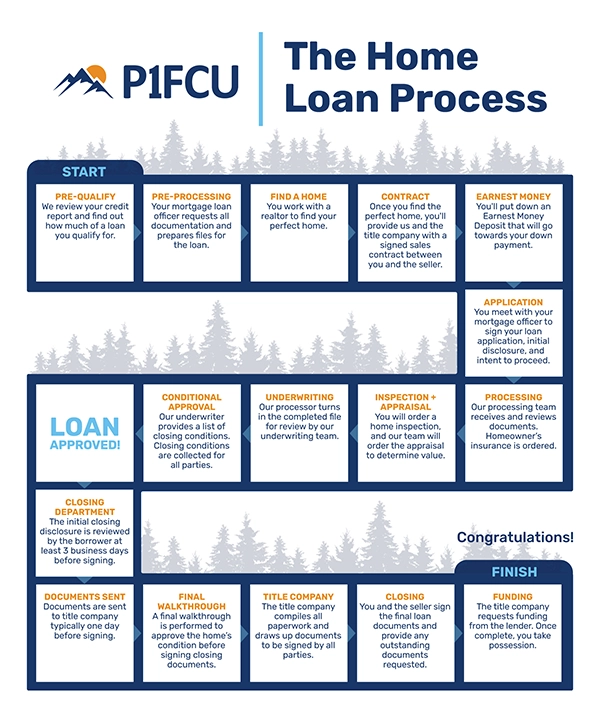

House Buying Timeline

Everything that happens from contract to closing.

Once you have your purchase contract, you'll be ready to proceed further in the actual processing of your mortgage application. We work hard to make the process of closing on your mortgage as smooth as possible.

Here's a timeline of what happens once a seller has accepted your offer between the lender, buyer, and title company:On average, this entire process takes 52 days, and a lot can change in your life during that time. Due to the strict regulations surrounding mortgage lending, your lender will want to see your financial condition stay the same the entire time. Here are some dos and don’ts to follow from start to finish:

| DO | DON'T |

|---|---|

|

|

What happens next?

Once the closing is done, you're now the legal owner of that property. You'll get the keys and can move in! This should be a sigh of relief for you as this big purchase is complete. Going along with moving in as a homeowner, you'll also be in a different financial situation than you were before.

What is included in my mortgage payment?

Once your loan has been funded, you'll start making payments the first month after you've closed on your loan. All of our mortgages are due on the first of the month, so you'll need to figure out what payment method works best for you. This time is also a good time to decide if you'd like to make additional payments toward your principal balance each month.

Principal, Interest, and Escrow go into your mortgage payment.

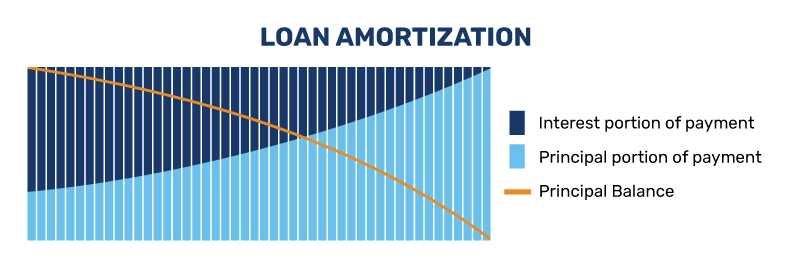

Your mortgage payment consists of three elements: your principal, interest, and escrow. Each year, your payment amount is fixed at a certain amount, then you pay interest, principal, and escrow based on where you are at in your loan.

Interest: Each month, the amount of interest you are paying is calculated based on the amount of your mortgage you still owe, multiplied by its interest rate, and divided by twelve. For example, if your current loan balance is $250,000 and your interest rate is 4%, you will pay $833 in interest each month based on the below equation:

(250,000 x .04)/12 = 833

Escrow: Your escrow pays your property taxes and home insurance. Each year, the amount you will owe in escrow will be estimated by your mortgage company and distributed between your twelve payments. Fluctuations in property taxes and home insurance can cause the most change in your payment year to year.

Principal: This is a payment towards the loan balance. The amount you pay in principal will go up as the balance goes down and the amount in interest you're paying goes down, but your monthly payment stays the same. This process is amortization.

Invest in Your Home

Real estate is frequently referred to as a "good investment." Your home is much more important to you than its return on investment. Real estate does tend to increase in value over time. Furthermore, the work you put into your home will increase its value. The kitchen remodel you have planned down the line will benefit you while you're in your home and your home's value when you eventually sell in the future.

We know purchasing a new home and moving is a costly process, but we want you to remember how much more financial independence you're gaining in the long term by purchasing a home. We hope that your new home brings you many years of happy memories, growth, and financial stability.

Do you want to know more?

Amortization: The process of paying down your loan through regular payments.

APR: Annual Percentage Rate, this is a numerical representation of the interest you will be paying on your loan.

Appraisal: An estimate of your property’s value. Most mortgage lenders require this before funding the loan.

Closing: Closing is the finalization of the home purchase process. You'll sign all the documents that finalize your purchase at closing. This is also when you pay any closing costs associated with your mortgage.

Closing Costs: In the simplest terms, closing costs include the actual costs associated with purchasing real estate. This includes things like appraisal fees, credit report fees, taxes, recording fees, attorney's fees, and loan origination fees. These fees must be paid outright at closing and cannot be covered by your loan.

Collateral: Something of value that a lender is securing the value of your loan against. Most mortgages are secured against the property you're purchasing.

Debt to Income: Commonly abbreviated to DTI, this is a ratio of how much debt you owe and how much your income is. Lenders calculate DTI by dividing monthly debt by gross income. Your DTI dictates how much of a monthly payment you will be approved for.

Down Payment: The amount of your home purchase that you will pay for with cash instead of your mortgage.

Earnest Money: Earnest Money is part of your down payment and is paid to sellers before closing. This shows sellers that the buyer is serious about their deal. At closing, this money goes towards the home purchase.

Escrow: A third party receiving and disbursing money on behalf of another entity. In the context of mortgage lending, a payment made towards your lender, which they hold until they are needed. Escrow payments cover real estate taxes and insurance.

Equity: The difference between the value of your home and the amount you owe on your mortgage. In simple terms, this is the amount of your home that you own outright.

Fannie Mae and Freddy Mac: Shorthand for the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation, respectively. These organizations are two of the largest sources of home mortgage funds.

Fixed Rate: An interest rate that remains the same throughout the life of the loan.

Gifted Down Payment: Just as it sounds, a gifted down payment is a down payment that has been provided to you as a gift from someone else.

HOA: Home Owner's Association, these are private associations in a specific subdivision, condo, or planned community that makes and enforces rules for the community.

Home Insurance: Insurance that protects homeowners against the cost of damages to their property caused by most natural disasters. Sometimes it is called hazard insurance.

Inspection: Examination of the property to find any problems the home may have, from foundation to wiring to animal infestations and more. While not always required by a mortgage lender, we can't recommend an inspection enough before buying.

Interest: The price you pay to borrow money from a lender. Usually, this is reflected as a percentage of the amount of the loan.

Lender: The financial institution that is lending funds to a borrower.

Mortgage: A legal document that allows a borrower to pledge their property as collateral for a loan used to purchase a property. The loans procured by mortgages, called mortgage loans, are frequently shortened to the word mortgage.

Neighborhood Covenant: A set of rules that govern the use of real estate within a certain neighborhood or subdivision. These can exist without an HOA.

PMI: Private Mortgage Insurance, additional insurance that is usually required when mortgage loans cover more than 80% of the home's value. This insurance protects lenders against losses should a borrower default on their loan.

Points: Fees paid at closing to reduce your interest rate.

Prequalification: A lender will determine how much you will be eligible to borrow before you apply for your loan. This prequalification can be leveraged when making offers on homes because it shows sellers that you can secure the funds needed to follow through on your offer.

Property Tax: Taxes that are charged to you as a homeowner based on the value of your home.

Real Estate Agent: Someone who is licensed and capable of negotiating the purchase and sale of real estate for buyers and sellers. Real estate agents can be Realtors if they're part of the National Association of Realtors.

Underwriting: A financial institution's process of evaluating a borrower's application, the property being lent against, and the risk involved in the loan.

Become a member

Get Started