Credit Score

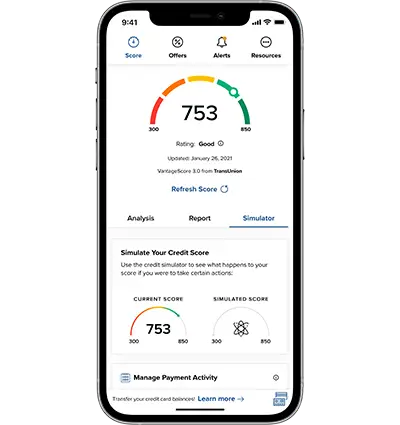

Get to know your score and much more.

A credit score is a fundamental part of your financial well being and future. When you need to be able to make large purchases like vehicles or homes, you need a good credit score to make those purchases.

Keep track of your score in your Digital Banking today.

How to Enroll:

- In Digital Banking, click on Credit Score in the Menu

- Click Get Started, enter your Date of Birth and answer a few questions

- You'll be set with unlimited access to your credit report

r

|

|

How monitoring your credit score can help youGet customized analysis of your credit report.

Use the simulator to see how actions will affect your score.

Set goals for your score

|

Have Questions? We've Got Answers!

Whether you are looking for more information about you credit score, or are curious about membership, loans, or digital banking, our FAQs have you covered. They're a quick, easy way to find what you need when you need it.

Check Out Our FAQs

5 Credit Score Myths, Busted

Credit scores can be confusing! Here are five common myths, and the truth about them.

Understanding Credit Scores: An Introduction to Your Financial Reputation

Your credit score is essential to your financial well-being, but do you understand what it does?

Who Calculates Your Credit Score?

In order for lenders to find your credit history, they rely on credit bureaus and reporting agencies to provide them with it.