Every expense associated with buying a home

by: Wes Gossage

vp of Mortgage Lending

Published 7/17/2024

Buying a home is more complicated than other large purchases.

The number of homes for sale is currently up 15.3% compared to this time last year. With inventory up, now is a great time to buy.1 If you're buying for the first time, or it's time for a refresher on the process, we'll break down the up front costs needed to purchase a home.

The cost of buying a home

Earnest Money Deposit: 1%-3% of purchase price

This deposit is a show of good faith once you've signed an offer that you're intending to move forward with the purchase. This deposit is put toward your down payment.

Down Payment: 3%-20%+ of purchase price

One of the most common upfront expenses associated with purchasing a home, your down payment, is the amount of your home you're paying for upfront. Down payments can be as low as 3% for first-time buyers but tend to be around 20% of the purchase price for most buyers.

If you pay less than 20% for your down payment, most lenders will require borrowers to have PMI, or mortgage insurance, which increases your monthly payment amount, until you have 20% equity in your home.

Inspection: $200-$1000

Home inspections range in price depending on inspector, areas inspected, additional inspection criteria, and the market you're shopping in. This is an expense not included in your closing costs, but one you pay out of pocket.

Closing Costs: 3%-6% of the purchase price

The term closing costs is used as a catchall for several of the fees that accrue during the home loan process. These are just a few common costs included in your closing costs. Closing costs cannot be included in your loan and must be paid at your loan's closing.

Appraisal: Whether it's included in closing costs depends on your lender. The appraisal is ordered well in advance of closing and ensures your home isn't undervalued compared to the loan you're getting for it. This is a necessary fee to procure your loan.

Origination Fee: This fee helps take care of the administrative costs associated with processing a mortgage application, covering all sorts of miscellaneous expenses like couriers between the lender and title company, initial home insurance purchases, flood projections, and so on.

Application & Credit Report Fees: There is also a small fee associated with processing the application and pulling your credit report. This amount varies from lender to lender.

Title Fees: This includes title insurance and the administrative costs incurred by the title company that processes the real estate transaction. Title insurance covers the buyer and prevents the potential for claims of back taxes, liens, or conflicting wills. The title company does a deep search of all records relating to the property to prevent these sorts of issues.

Transfer Tax: Transfer taxes vary greatly depending on where you live and depending on the transaction. For example, every county in Oregon outside of Washington County does not charge a transfer tax. Furthermore, the state of Idaho does not charge a transfer tax but there are nominal fees in each county for real estate title transfers. Meanwhile Washington has statewide rules that will run most home buyers 1.10%-1.28% of their purchase price.

This is a non-exhaustive list of closing costs, and they vary based on the type of loan you're procuring, the home you're buying, whether you're moving from one state to another, and so on. One option you can discuss with your realtor is to negotiate to have the sellers cover a portion of the closing costs.

Moving: Anywhere from $200-$10,000+

Remember, you're not only buying your new home, buy you're also moving into it. The cost of moving varies greatly from person to person and move to move. If you're not renting a moving truck or hiring movers, your expenses will be relatively low, but factor in the cost of boxes, packing supplies, and even additional cleaning supplies for your new home. You should also budget for snacks and pizza for your moving helpers.

If you hire movers, or rent a moving truck that will bring your expenses up a bit. Moving companies range from as low as $2,000 to well over $10,000. This price entirely depends on how far you're moving and how much stuff you have to move. If you're doing a cross-country move, you may need to look into additional insurance for your items if you're not moving with them.

We're not rounding up all these expenses to scare you but to provide you with a realistic picture of the home-buying process. Sometimes home buyers come in only thinking about the purchase price, or the down payment. The additional costs associated with moving and closing on a home eventually pay for themselves with the increase in property value.

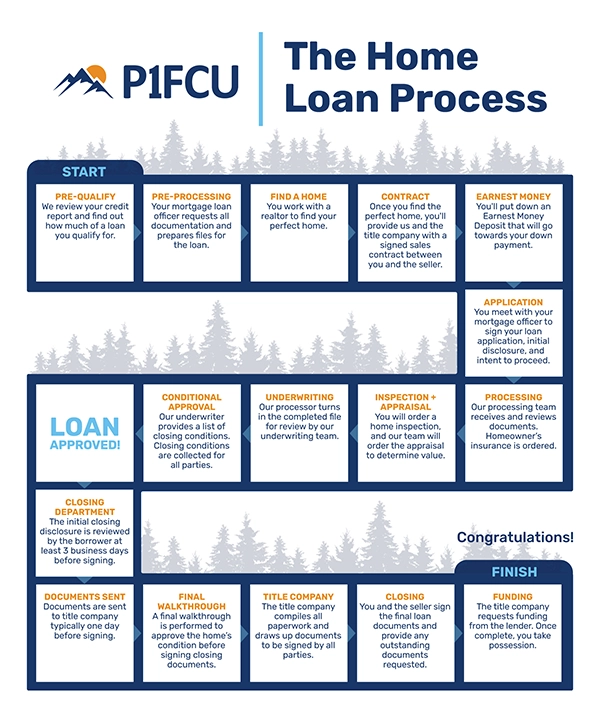

Every step in the home buying process from start to finish

To get a bigger picture of the entire home buying process, the diagram below breaks down the transaction from start to finish. On average, from beginning to end buying a home takes 52 days. It takes longer because it's a more intricate loan. There is communication between the lender, the realtor, the title company, and you. You have to build in time for underwriting approval, and timing has to work out for the sellers as well.

Prequalification: When you submit an application to see how much of a loan you can qualify for, and will provide you with proof you can secure funding, which you can show to sellers.

Find a Real Estate Agent and Go Shopping: Be sure to have a list of wants, needs, and must-haves when shopping around!

Make an Offer and negotiate a contract: Once you find the right home, work with your real estate agent to make an offer. You may go through a few rounds of negotiations, or you may even have to walk away and move on to a new house. That said, when the sellers have accepted your offer, you will have a contract and can proceed with the loan process. Your contract will be submitted to the title office and your lender.

Earnest Money Deposit: This is a deposit that goes toward your down payment, and is a show of good faith in the process that you're moving forward with the process. This isn't always required but is very common in the home buying process.

Application and Processing: You'll sign your official application to move your loan from the preapproval stage to the formal application stage. Your lender's processing team will review all of your documents and order homeowner's insurance.

Inspections and Appraisals: Should you choose to do an inspection, this is when you would order one. An inspection, while not required by your lender, is a great idea to ensure there are no major flaws to the home that you can't see prior to purchasing. Your lender will also order an appraisal to ensure your home's value matches the amount you're borrowing.

Underwriting and conditional approval: Once your lender has the appraisal back, your loan moves to the underwriting team. This is when any additional closing conditions may be added, and your loan is approved!

Closing Disclosures: At least three business days before your loan signing, you will receive closing disclosures. This way you have time to review these documents before signing. At this time, all documents are sent to the title company, who is compiling all the paperwork from all parties.

Final Walkthrough: In the last days before closing, you'll do a final walkthrough of the home to approve of the home's conditions before signing all of the closing documents that finalize the purchase.

Closing: At the closing, you and the seller sign all the final loan documents and provide any outstanding documents that have been requested. Once all parties have signed all the documents, the title company will request funding from the lender. Once this is complete, you take possession of the property and are now the owner!

Buying a home is a complicated transaction, and the purchase is just the beginning. Once you're an owner, you're committed to payments, maintenance, property tax and insurance, and much more. That said, it's also massively rewarding, otherwise it wouldn't be a huge goal millions of owners have worked toward, right?

You're setting yourself up for success with a stable payment, a long term investment, and a place you get to call home at the end of the day. Buying can be a discouraging process, but it's massively rewarding in the end.

First Time Home Buyer's Guide

All the information to take in as a first time home buyer can be overwhelming to say the least. Our guide outlines the process for you.